When the complexity and overwhelm set in, our expert financial planners recommend getting back to basics and reviewing the core principles to bring back clarity and confidence for future decision-making.

Investing is often seen as complicated and complex. This is further heightened during times like the present where we are facing continued uncertainty around inflation, interest rates, the fighting in Eastern Europe (geopolitical events) and our little friend Covid that seems to be a never-ending story.

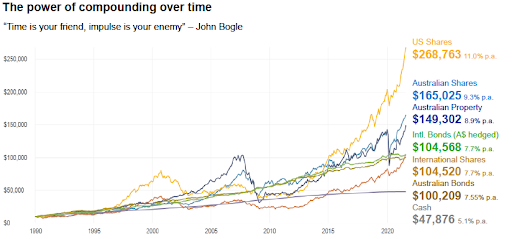

As investors we need to focus on what we can control, such as some timeless basic investing principles. This can include having clear and realistic investment goals, having a well-diversified portfolio, suitable asset allocation, always investing with a margin of safety, ensuring we have long term discipline, continually making regular contributions where possible (accumulators) and understanding the true power of compounding returns.

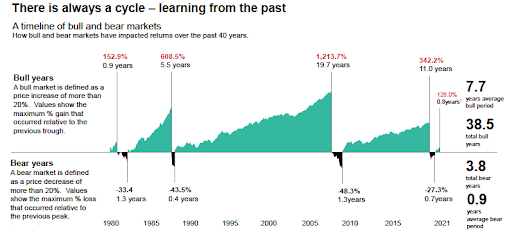

Nobody has a crystal ball and significant events can occur with little warning that create a short-term shock or increased volatility. We have all been witness to this only very recently with the entire world shutting down as Covid took hold. Markets across the globe fell sharply over a very short period of time.

Several factors contributed to the bounce back and that’s for another day; the point is if we focus on what we can control, even through periods of increased volatility, history has shown again and again the benefits of the basics.

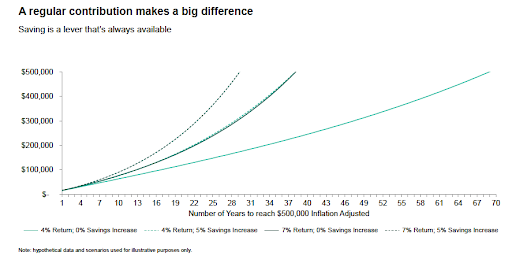

A few charts below visualise some of the benefits of these investment principles.

This here is my favourite for any accumulator especially. The benefits of regular contributions show the reduction in time it takes to reach an outcome. For the more risk averse among us this also provides some comfort in terms of risk mitigation and reducing the likelihood of investing funds at the peak of a cycle, which is obviously unsettling when volatility creeps in and markets fall.

Selling shares or switching to a more conservative strategy after falls in markets just turns a paper loss into a real loss. Regular contributions or further investment through periods of uncertainty create opportunities for longer term investors.

In a time where technology, social media, online news, and financial publications are found at the click of a button, blocking out the noise is easier said than done. These platforms only increase the likelihood of making irrational decisions that can impact our investment goals over the long term. As highlighted in the visuals above, if we continue to focus on the basics while reducing the noise your investment journey will inevitably be less stressful and more profitable.

As advisers, our roles is to keep you on your investment journey, limit irrational decisions and ensure asset allocations and underlying investments are where they should be to meet your specific goals.

If you or anyone you know would like to chat further about anything mentioned above, please don’t hesitate to reach out to myself or the team at Diamond Partners.

Kaine

Source of charts:

Vanguard